Why Bonds Are Low Risk

Feb 17, 2024 By Susan Kelly

These are loans to large institutions like cities, corporations, and nations. They tend to repay loans as opposed to individuals. Rating agencies for bonds study every bond and company. They provide information on the security of these bonds. This gives investors good reason to believe that a particular bond is safe. Bonds can be sold in a market that is open to the public. They're securities that are simple to trade, meaning that the investor does not have to hold the bond for the duration that the bond is in.

However, different kinds of bonds come with different levels of risk. Bond investors seek reliable outcomes, while certain investors are willing to accept greater risk to obtain a greater return. Investors continuously evaluate the bond risk associated with the benefits of interest rates. The bonds with the highest risk, such as bonds issued by junk companies and those in the market, also offer the highest returns. Bonds with moderate risk and returns include the majority of corporate bonds.

These bonds compete with mortgages for investors. However, Treasurys have the greatest impact on mortgage rates. The other bond will appear more attractive investment options when Treasury rates are high. If Treasury rates increase, other bonds will also have to increase their rates to draw investors.

Treasury Bonds Drive Mortgage Rates

Since they are more long-term bonds - typically 15 or 30 years old- and reliant on repayment by the individual to be repaid, mortgages are at greater risk than most bonds. U.S. Treasury notes offer similar lengths of term, at 10, 20, and 30 years. They are also extremely safe because of their backing by the government. This means that the investors don't need high rates.

Banks set mortgage interest rates just a few percentage cents above Treasury notes. These few points of better yield are enough to draw most investors towards mortgages. Since the interest rate of U.S. Treasury notes rises, banks will be able to increase the interest rates for new mortgages. Buyers of homes will be required to pay more every month to get similar loans. This means they have less money to pay for the cost of the house. Typically, when interest rates increase, home prices ultimately fall.

Treasurys Affect Fixed-Rate Mortgage

Treasury yields do not affect fixed-rate mortgages. The 10-year note impacts conventional loans of 15 years, and 30-year bond applies to 30-year loans. Suppose Treasury rates increase the rates of these mortgage. Banks know they can hike rates when their main rivals do so.

The Federal Reserve affects adjustable-rate and short-term mortgages. The Fed determines the target of the fed funds rate -- the amount banks are charged for loans needed to keep their reserve requirement. This is a direct effect on the following:

- LIBOR is the price banks pay each other for loans that range from overnight to one year.

- The prime rate is the rate banks charge their most valuable customers.

These affect variable-rate mortgages and other loans, independent of Treasurys or other obligations. The rates usually reset every few months.

Rising Rates in Recovery

2012-2013 were the most expensive house prices regaining after a drop of 33% due to the Great Recession. Prices started to rise. That was the message that real estate investors wanted. When prices increased, they were once more convinced that housing was a great investment. Many buyers utilized cash sitting on the sidelines or placed in other commodities, like gold. They didn't care about interest rates increasing since they didn't have mortgages.

Others who bought homes needed mortgages; however, they knew ample room for prices to climb even higher. They believed that real estate could be an investment worth making even if interest rates increased. When the value of homes resold rose, the number of homeowners over their mortgages might be able to sell their houses and get an alternative finally.

Last but not least, many workers returned to work for the first time in many years when the economy was improving. They'd lived with relatives or with friends and were able to have the money to purchase a house. Therefore, even though the increase in bond rates led the mortgage rates to rise, it didn't affect home prices. Bonds and U.S. Treasury notes have a strong connection to mortgage rates. Knowing what's happening within the bonds market will give you an idea of what's to come in the mortgage market.

-

Mortgages Dec 23, 2023

Mortgages Dec 23, 2023A Step by Step Guide to Mortgage Transfers

The content discusses the process of a mortgage transfer, from determining if it is necessary to understanding the different types of transfers available.

-

Mortgages Jan 12, 2024

Mortgages Jan 12, 2024Flagstar Bank Mortgage Review: A Comprehensive Guide

Explore Flagstar Mortgage: Loan options, rates, eligibility. Make informed decisions with our comprehensive review.

-

Know-how Oct 18, 2023

Know-how Oct 18, 2023Optimizing Web Performance: A Deep Dive into Performance Budgets—Pros and Cons

Dive into the world of web optimization with our guide on performance budgets. Discover the power and pitfalls as we explain how to strike the perfect balance.

-

Know-how Feb 15, 2024

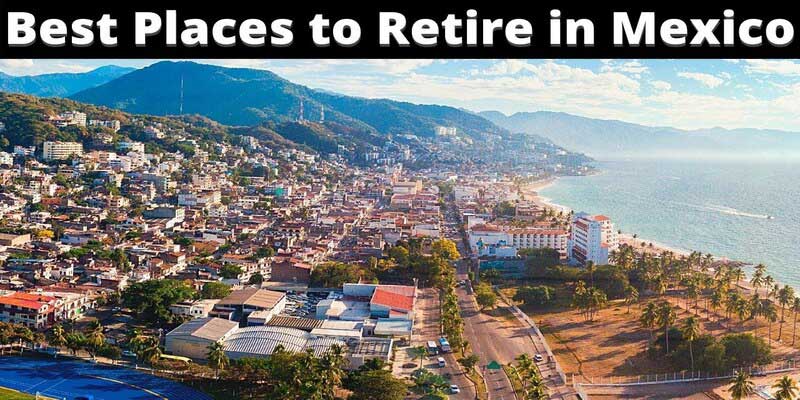

Know-how Feb 15, 2024Where To Live When You Retire In Mexico

U.S. and Canadian retirees have long found a welcoming community in Mexico. Retirement in Mexico may be enjoyable thanks to the country's favorable climate, stunning beaches, low cost of living, and fascinating history